Ibadan’s real estate market is thriving, especially in the luxury sector. From the tranquil streets of Kolapo Ishola GRA to the bustling areas around Akala Express, more Nigerians are recognizing the value of investing in high-end properties. However, one of the biggest questions prospective buyers face is, “How can I finance this investment?” In this guide, we’ll explore various financing options available, helping you choose the best approach to finance your luxury property in Ibadan.

The Importance of Choosing the Right Financing Option

Before diving into the specifics, it’s important to understand why choosing the right financing method is crucial. Buying a luxury property is a significant investment, and how you finance this purchase can greatly affect your financial stability and future returns. Whether you’re opting for a mortgage, a personal loan, or a specialized real estate financing option, making an informed decision will ensure that your investment in Ibadan’s luxury real estate market is both secure and profitable.

Mortgage Options for Luxury Property in Ibadan

One of the most common ways to finance luxury property in Ibadan is through a mortgage. Mortgages offer a practical solution by allowing buyers to spread the cost of the property over several years, making the purchase more manageable. Here are some key points to consider when exploring mortgage options:

- Traditional Bank Mortgages: Many Nigerian banks offer mortgage services tailored to the real estate market. These mortgages typically require a substantial down payment often around 20-30% of the property’s value. The interest rates can vary, so it’s essential to shop around for the best deal. Additionally, the loan tenure usually ranges from 10 to 30 years, depending on your financial capacity and the bank’s terms.

- Private Lenders: In addition to traditional banks, private lending institutions offer mortgage services. These lenders often have more flexible terms and quicker approval processes, which can be advantageous for buyers looking to close deals quickly. However, it’s important to note that private lenders may charge higher interest rates, so it’s crucial to evaluate whether this option aligns with your financial goals.

- Government-Backed Loans: In some cases, the government provides support for real estate investments, particularly for first-time buyers. While these programs are more commonly associated with affordable housing, there may be opportunities to leverage government-backed loans for luxury properties under certain conditions.

Personal Loans for Real Estate Investments

Another option to consider when looking to finance luxury property in Ibadan is a personal loan. Unlike mortgages, which are secured against the property, personal loans are typically unsecured. This means that while they may come with higher interest rates, they do not require collateral. Here’s how personal loans can be used for your luxury home purchase:

- Flexibility: Personal loans offer flexibility in terms of how the funds are used. This can be beneficial if you need additional capital for renovations or if the property you’re purchasing is not eligible for a traditional mortgage due to its condition.

- Shorter Repayment Periods: Personal loans often come with shorter repayment periods compared to mortgages. This could be advantageous if you prefer to pay off your loan quickly and avoid long-term interest payments. However, the monthly repayments will be higher, so it’s important to ensure that this aligns with your financial situation.

- Credit Score Impact: Since personal loans are unsecured, they rely heavily on your credit score. A higher credit score will typically result in more favorable loan terms, including lower interest rates. Therefore, it’s advisable to check and improve your credit score before applying for a personal loan.

Real Estate Investment Partnerships

For those looking to buy luxurious property in Ibadan without taking on all the financial burden alone, real estate investment partnerships can be an excellent option. This approach involves pooling resources with other investors to purchase a property collectively. Here’s why this might be a good choice:

- Shared Risk and Reward: By partnering with other investors, you can share both the risks and rewards associated with the property. This can make high-value investments more accessible and reduce individual financial exposure.

- Leveraging Expertise: If you’re new to the luxury real estate market, partnering with experienced investors can provide valuable insights and reduce the learning curve. This collaborative approach often leads to better decision-making and higher returns.

- Flexible Investment Structures: Real estate partnerships can be structured in various ways, from joint ventures to limited liability companies (LLCs). This flexibility allows you to choose a model that best suits your financial goals and risk tolerance.

Choosing the Best Company to Buy Luxurious Property in Ibadan

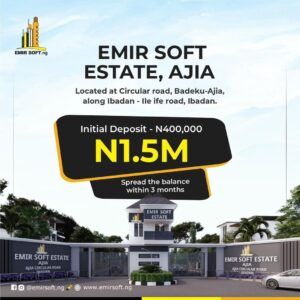

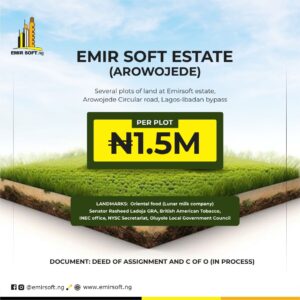

Selecting the right real estate company like Emir Soft Properties is crucial when purchasing luxury property. The best company to buy luxurious property in Ibadan should offer more than just listings; they should provide comprehensive support throughout the buying process. Here’s what to look for:

- Expertise in Luxury Real Estate: The company should have a deep understanding of the luxury market in Ibadan, including knowledge of the most sought-after neighborhoods and properties. They should also be able to advise on the best financing options available.

- Transparent Transactions: Transparency is key when making such a significant investment. The best company to buy luxurious property in Ibadan should provide clear information on pricing, terms, and any potential legal considerations. This ensures that you’re fully informed and confident in your purchase.

- Post-Sale Support: Beyond the purchase, the company should offer support with any necessary legal paperwork, property management, and future resale opportunities. This comprehensive service ensures that your investment remains profitable and hassle-free.

At Emirsoft Group, we pride ourselves on being the best company to buy luxurious property in Ibadan. Our team is dedicated to helping you navigate the complexities of the luxury real estate market, from finding the perfect property to securing the best financing options.

Conclusion

Financing your luxury property purchase in Ibadan doesn’t have to be overwhelming. Whether you’re considering a mortgage, a personal loan, or a real estate partnership, there are plenty of options to make your investment a success. By choosing Emir Soft Properties as one of the best company to buy luxurious property in Ibadan, you can ensure that your investment is not only secure but also profitable in the long run.

Investing in Ibadan’s luxury real estate market is a decision that requires careful planning and the right support. With the right financing strategy and a trusted real estate partner, you can achieve your goals and enjoy the many benefits of owning a luxurious home in this thriving city.